Guest commentary by Larry Hughes, Dalhousie University, who has been on sabbatical with the Atlantica Centre for Energy since January 2025.

This commentary first appeared in The Halifax Examiner on May 22, 2025. It is shared with the author’s permission.

Nova Scotia Power’s first quarter Management Discussion and Analysis for 2025 offered some surprising news, high energy costs, supply chain issues, and global demand for wind turbines saw the company return to an old energy source to help it get through the winter, coal.

First quarter 2025 load

Demand for electricity in Nova Scotia changes throughout the year, from a summertime minimum in the third quarter of the year (July through September), to a maximum in the first quarter of the year (January through March).

The first quarter maximum is the result of shorter, colder days requiring more electricity for lighting, indoor entertainment, and heating.

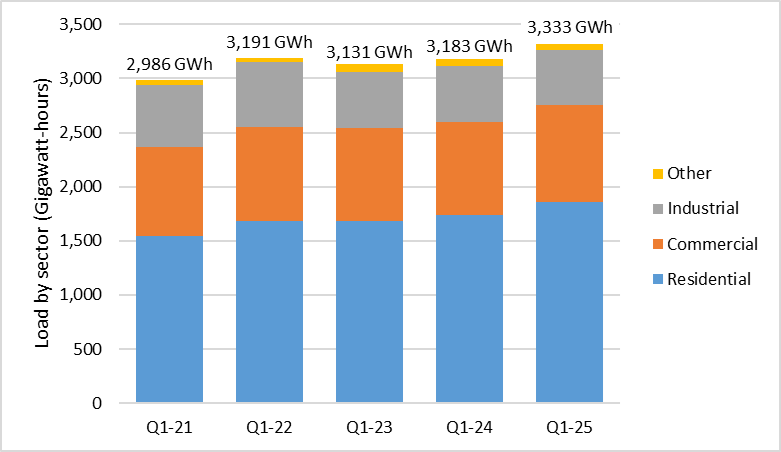

As the following chart shows, the province’s demand for electricity has grown by almost 12% over the past five years, from 2,986 gigawatt-hours in the first quarter of 2021 (Q1-21) to 3,333 gigawatt-hours in the first quarter of 2025 (Q1-25).

Nova Scotia Power’s electricity load by sector for the first quarters of 2021 through 2025

Most of this growth can be attributed to a 20% growth in residential sector load, the result of increases in the province’s population (between the first quarters of 2021 and 2025, Nova Scotia’s population grew by 89,602) and colder than average winters in the first quarters of 2022 and 2025.

In Q1-25, Nova Scotia’s load was 150 gigawatt-hours more than in Q1-24.

Meeting Nova Scotia’s electricity load

The additional load in the first quarter of 2025 meant that Nova Scotia Power had to supply more electricity from somewhere.

(I say “supply” rather than “generate” because Nova Scotia Power is increasingly reliant on electricity not only from its own generating facilities, but also from Newfoundland and Labrador Hydro, New Brunswick Power and beyond, and numerous independent power producers [IPPs] based in Nova Scotia.)

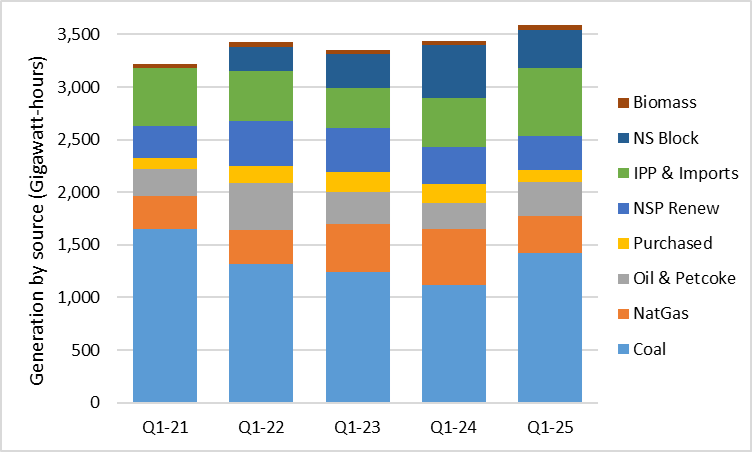

As the next chart shows, the energy sources Nova Scotia Power has used to meet provincial demand have changed little over the past five years, although the volumes used have changed.

Between Q1-21 and Q1-24, the percentage of electricity from coal fell from 51% to 33%. This was offset by natural gas (increasing from 10% to 16%) and the Nova Scotia Block, electricity supplied by Newfoundland and Labrador Hydro from Muskrat Falls (increasing from 0% to 15%).

However, between Q1-24 and Q1-25, while load increased by 150 gigawatt-hours, renewables production increased by only 21 gigawatt-hours.

(The decrease in renewables in Q1-25 was not due to problems with the Maritime Link or Newfoundland and Labrador Hydro. The Nova Scotia Block in Q1-24 was larger than normal because it included part of Newfoundland and Labrador Hydro’s obligation to make up the volume it failed to supply in 2020 and 2021 by the end of 2024.

(In Q1-25, the Nova Scotia Block volume met Newfoundland and Labrador Hydro’s quarterly obligation for 2025. The sharp increase in the volume of “IPP & Imports” was due, in part, to Nova Scotia Power purchasing “market-priced electricity” from Newfoundland and Labrador Hydro.)

Nova Scotia Power’s energy sources for the first quarters of 2021 through 2025

In other years, Nova Scotia Power would have used natural gas and purchased electricity from other provinces, but the cost of these sources had doubled. Consequently, Nova Scotia Power turned to coal and petcoke (petroleum coke) to meet the demand.

And the remainder of 2025?

Load-serving entities (like Nova Scotia Power) must ensure that 40% of their electricity come from renewable sources by 2020 and 80% by 2030. While in the province’s case, emissions are to be 53% below 2005 levels by 2030, which will require total electricity emissions (from Nova Scotia Power and other load-serving entities) to be about one megatonne.

In the 2023 and 2024 calendar years, Nova Scotia Power met the 40% renewables target, and its emissions declined, from 6.1 megatonnes in 2021 to 5.3 megatonnes in 2024.

Whether the limited growth in renewables and increased use of coal and petcoke in Q1-25 will affect Nova Scotia Power’s renewables target this year and reverse its downward trend in emissions will depend on the price of natural gas, the volume of electricity available from Newfoundland and Labrador Hydro, the amount of wind and sun the province receives, and whether any of the promised wind farms, delayed by supply-chain issues and the worldwide increase in demand for wind turbines, are completed in 2025 or 2026.

Although this runs counter to our climate objectives, we should be thankful that Nova Scotia Power still had access to coal this winter.

Larry Hughes is a professor in the Department of Electrical and Computer Engineering at Dalhousie University.

The work described in this article was not funded by the federal or provincial governments or any other organization.